Silver Trading Bot & Live Gold Pricing

Institutionally-Proven Automated Silver Trading Algorithms

EndoTech Algorithms trade Silver and Deliver Results.

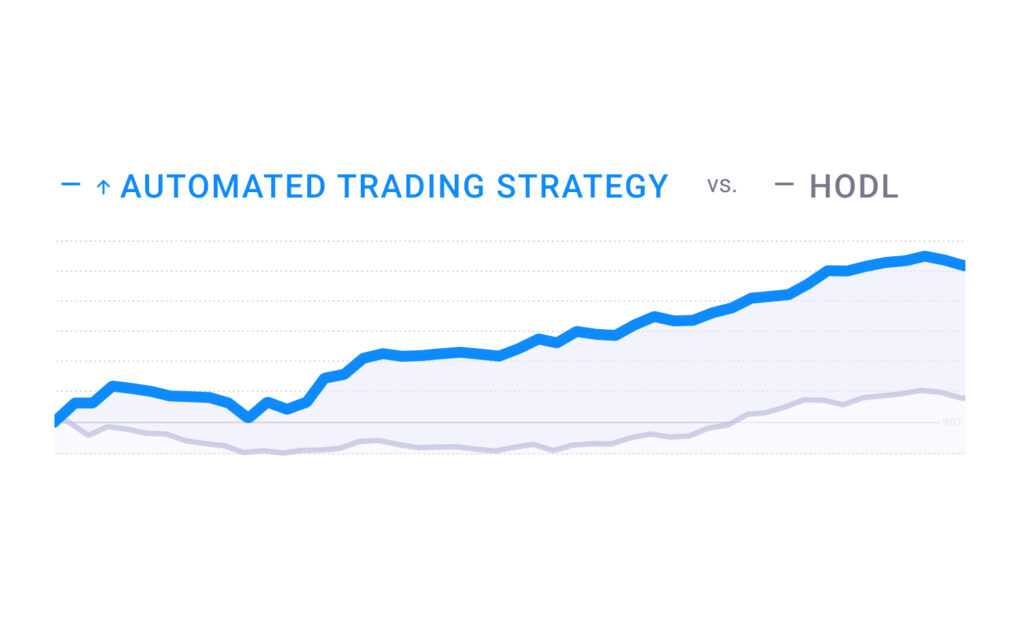

Clients using EndoTech’s automated trading strategies to get Alpha exposure while enjoying proven risk management. Instead of a failed ‘buy and hold’ (HODL) approach, Silver trading algorithms deliver results securely and automatically. Imagine the power of connecting to the Silver trading strategy that trades automatically executed on your account through a secure API.

Silver Trading Basics:

Silver trading involves buying and selling various forms of the metal, including coins, bullion, bars, and shares in silver mining companies. Traders work on exchanges or through brokers to buy and sell silver. The price of silver is influenced by industrial demand, currency exchange rates, and global supply and demand. When trading silver, investors must take into account the cost of storage, insurance, and other costs associated with holding the metal. Hedging and arbitrage strategies are often used by traders to take advantage of movements in the silver markets.

Silver Trading Bots:

Silver bots are automated trading programs or algorithms that buy and sell silver on the futures market. They monitor and analyze market data, identify trading opportunities, and execute trades with the goal of making a profit. Silver bots can be used to trade a variety of silver products, including silver futures, options, and exchange-traded funds (ETFs). Silver bots are programmed to identify and exploit market inefficiencies, and they can be used to trade both long and short positions. Silver bots are often used by professional traders as they require less time and effort to monitor and execute trades.

Silver Trading Strategies Outperform Buy and Hold

Algorithmic silver trading strategies are a set of strategies designed to outperform the ‘buy and hold’ investing. These strategies involve actively trading and taking advantage of market inefficiencies to boost returns. The strategies are based on the principles of technical and fundamental analysis and involve using indicators such as moving averages, support and resistance levels, and other chart patterns. The strategies also involve risk management techniques such as stop-loss orders and position sizing. While these strategies can produce higher returns, they also involve more risk and should only be used by experienced traders.

How to choose the right silver trading strategy for you?

A trading strategy is a high risk, high reward investment. You are invited to consult with our success team by setting up a consultation here or speaking with them via WhatsApp and Telegram

Choosing the right strategy is generally based on the following parameters:

- Risk/reward profile – Different strategies have different risk parameters. You should use risk capital only

- Capital requirements – How much capital is available and how much diversification

- Regulation – Different countries prevent clients from trading futures

- Crypto Exchange – Certain exchanges are better suited for different strategies. All EndoTech strategies list the exchanges supported

- Preference – Some clients have preferences for which coin to trade

How EndoTech works with...

EndoTech has a premier partnership with Binance and Binance.US. As such, we have access to service and support that individual investors do not. Our partnership is actively supported by Binance management as a leader in investment innovation. Technically, our trading algorithms use secure APIs to execute trade signals directly on client accounts and have no access to client funds.

Learn about how to connect EndoTech to Binance, Binance.US here

EndoTech has a deep partnership with Bitfinex. As such, our clients get service and support that individual investors do not. Our active partnership is rooted in the innovative algorithms that we bring to investors using their exchange. Technically, EndoTech’s trading algorithms use secure API connection to execute trading strategies directly on client accounts and have no access to client funds.

Learn about how to connect EndoTech to Bitfinex here.

![]()

EndoTech has a deep partnership with Coinbase Pro. With this partnership, EndoTech clients get premium service and support that individual investors do not. Our technical partnership allows clients to enjoy automatic trading strategies on their private wallets. This happens through a secure API that enables trades to execute directly on client accounts.

Learn about how to connect EndoTech to Coinbase Pro here.

Silver Live Pricing

Silver price by GoldBroker.com

FAQ

XAG:CUR

Silver Spot $/Oz

23.8675

Historically, silver and other precious metals were used to replace stocks and bonds. When times are tough or inflationary pressures are significant, some investors turn to silver to hedge their risks. Silver may be purchased as an outright investment or as a stock in companies that manufacture it.

Here are five different ways to own silver and a look at some of the risks that come with each.

- Silver Bars or Coins – physical silver, whether in the form of coins or bullion, is a psychologically and emotionally rewarding method to invest in silver. And in certain circumstances, it’s actually rather simple to obtain. Silver can be purchased online or through local merchants and pawn shops, as well as internet sellers such as APMEX and JM Bullion. Risks: Silver can be overpriced, so keep track of the current price to ensure a fair deal. You may not get the full value of your silver if you wish to get cash quickly, especially if you need to go through a dealer.

- Silver futures – Unlike real silver ownership, silver futures offer a simple way to trade in silver. Silver futures offer substantial leverage in the silver market, making them an appealing option for speculators. In other words, you need relatively little cash to have a substantial stake in the metal. Investing in silver futures can be very profitable if you get it right, but it can also be very costly if you get it wrong. Risks: You can suffer losses and gains when you leverage future contracts. If the market moves against you, you’ll need to put additional money up to keep the trade open. And if you can’t, the broker will close the transaction, leaving you with a loss.

- ETFs that own silver – A silver exchange-traded fund is a great way to own silver. You’ll have the potential reward of owning silver if the price rises, but fewer risks such as theft. Silver ETFs deliver a return based on silver prices minus the ETF’s expense ratio. There is another advantage to ETFs as well. Silver can be sold at market price, and the funds are highly liquid. However, silver, like gold and other commodities, are volatile assets. By using ETFs, you may avoid some of the more serious risks associated with real silver, like theft, illiquidity, and bad pricing.

- Silver mining stocks – Investing in silver mining firms can also make you money from a growing silver market. Owning a mining company can benefit you in two ways. As silver prices rise, so do earnings for the company. When all else is equal, silver mining companies’ earnings will rise faster than silver prices. Secondly, the miner may gradually raise production, thereby increasing earnings. OF course, if you do invest in a company, you should do extensive research on it to ensure you’re buying a high-quality, successful company. In addition, mining stocks can also be volatile due to the volatility of silver prices.

- ETFs that own silver mining companies- Invest in an ETF that owns silver mining companies give you a more indirect exposure to the silver market. You’ll have diverse exposure to mining companies while taking on less risk than if you owned just one or two mining-related equities. While investing in a sector-ETF reduces the impact of a single miner’s performance, but a fall in the silver price will damage the fund substantially. Keep an eye on what’s in those funds, since they aren’t all alike. The exposure is varied, with some focusing more on higher-quality companies and others on riskier junior miners.

The correlation between silver and stocks, bonds, and other commodities is relatively weak. Experts recommend investing 5% of your portfolio in commodities. Over the long term, silver has had much lower returns than the S&P 500. It may not be the best way to protect your portfolio in any given year or decade.

In the late 1970s, silver hit its highest price to date of US$48.70 per ounce. As a result of strong silver investment demand, it saw an uptick in price at that time. After reaching US$47.94 in April 2011, silver’s price plummeted. Silver breached the key US$26 level in early August 2020, and soon after tested US$30. Supply and demand are the two most important factors that affect silver prices.

Silver’s market capitalization is currently $1.333T. This is calculated by multiplying the current silver price by the total number of metric tonnes of silver that have been mined. Silver market cap estimations are more difficult than gold market cap calculations, and these figures are estimates. It is also worth noting that a significant amount of silver has been lost or destroyed as a result of industrial usage.

The 30 day Average Daily Volume at the end of 2022 was 18.5M, down from 40M in April 2022 and from the 5 year peak of 75 M mid 2020.

Approximately 1.5 million metric tons of silver have been mined. And 55% of silver that has been discovered to date are concentrated in only four nations. A cube with a side of 55 meters might contain all the silver that has been found thus far.

For many years, silver has been a well-liked store of value. Large and small investors alike now include silver in their investment portfolios due to their recognition of the metal’s inherent value. There are undoubtedly few other materials that are as useful, helpful, and attractive as silver. The element of change known as silver has played a significant role in altering the course of history, and there is little question that silver’s potential for change will continue to grow.