Oil Trading Bot & Oil Pricing

Institutionally-Proven Automated Oil Trading Algorithms

EndoTech Algorithms trade Oil and Deliver Results.

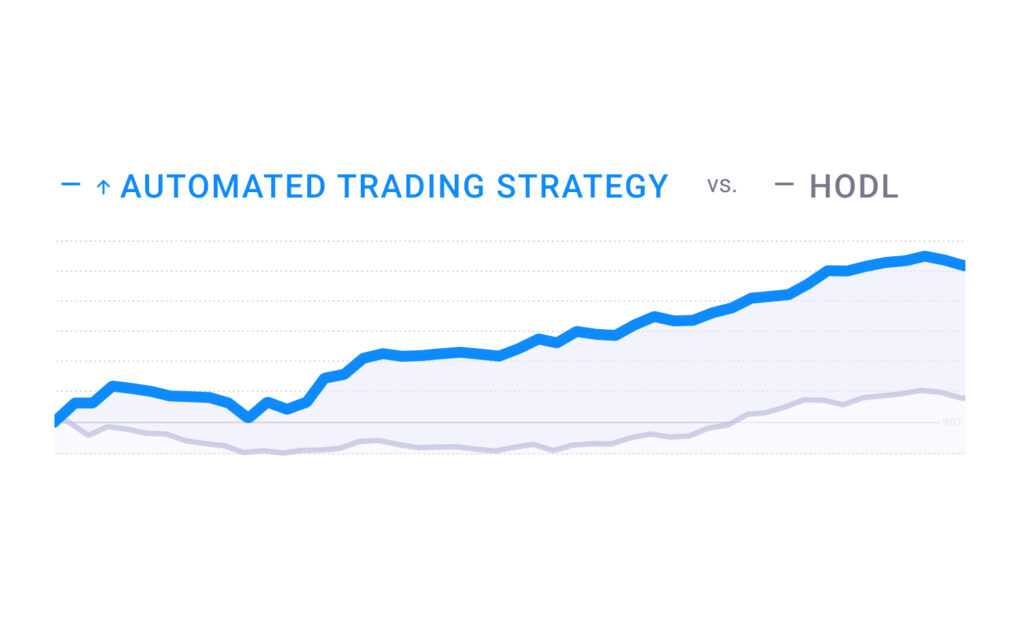

Clients using EndoTech’s automated trading strategies to get Alpha exposure while enjoying proven risk management. Instead of a failed ‘buy and hold’ (HODL) approach, oil trading algorithms deliver results securely and automatically. Imagine the power of connecting to the oil trading strategy that trades automatically executed on your account through a secure API.

Oil Trading Basics:

Oil trading is the buying and selling of crude oil and its derivatives on global commodity markets. It is a complex business that involves a wide range of participants, from oil producers to refiners to consumers.

Oil traders need to understand the supply and demand dynamics of the oil market, the different types of crude oil, the various grades of oil, and the different methods of trading oil. They also need to be aware of the different types of contracts and derivatives that are used for trading oil.

The most common type of oil contract is the futures contract, which is a contract for the delivery of a specified quantity of oil at a specific price and time in the future. Traders use these contracts to speculate on the direction of the price of oil, or to hedge against price fluctuations.

Other types of oil contracts include options, swaps, and forwards. Options give the holder the right, but not the obligation, to buy or sell a given quantity of oil at a specified price. Swaps are agreements to exchange payments based on the difference between the price of oil at the beginning and end of the contract period. Forwards are contracts to purchase a certain quantity of oil to be delivered at a given time in the future, at a specified price.

Traders must also be aware of the various factors that can affect the price of oil such as supply and demand, geopolitical events, weather, and economic conditions. Oil traders must understand the fundamentals of the oil market to be successful.

Oil Trading Strategies:

Automated oil trading strategies are automated computer programs that use algorithms and analytics to conduct oil trading. They are designed to buy and sell oil contracts on behalf of a trader based on predefined parameters. They can analyze market data and make decisions in real-time, which allows them to take advantage of market fluctuations quickly. They can also be used to manage risk and take advantage of market arbitrage opportunities.

Oil Strategies Outperform Buy and Hold

Oil strategies outperform Buy and Hold strategies. Oil trading strategies involve analyzing the market for buying and selling opportunities, taking into account supply and demand of the commodity, political and economic factors, and other factors. These strategies involve actively monitoring the market and taking advantage of price movements. Oil strategies are often more successful than simple speculation because they allow traders to take advantage of the market’s volatility and capitalize on the upside potential of oil prices.

How to choose the right trading algorithm for you?

A trading strategy is a high risk, high reward investment. You are invited to consult with our success team by setting up a consultation here or speaking with them via WhatsApp and Telegram

Choosing the right strategy is generally based on the following parameters:

- Risk/reward profile – Different strategies have different risk parameters. You should use risk capital only

- Capital requirements – How much capital is available and how much diversification

- Regulation – Different countries prevent clients from trading futures

- Crypto Exchange – Certain exchanges are better suited for different strategies. All EndoTech strategies list the exchanges supported

- Preference – Some clients have preferences for which coin to trade

How EndoTech works with...

EndoTech has a premier partnership with Binance and Binance.US. As such, we have access to service and support that individual investors do not. Our partnership is actively supported by Binance management as a leader in investment innovation. Technically, our trading algorithms use secure APIs to execute trade signals directly on client accounts and have no access to client funds.

Learn about how to connect EndoTech to Binance, Binance.US here

EndoTech has a deep partnership with Bitfinex. As such, our clients get service and support that individual investors do not. Our active partnership is rooted in the innovative algorithms that we bring to investors using their exchange. Technically, EndoTech’s trading algorithms use secure API connection to execute trading strategies directly on client accounts and have no access to client funds.

Learn about how to connect EndoTech to Bitfinex here.

![]()

EndoTech has a deep partnership with Coinbase Pro. With this partnership, EndoTech clients get premium service and support that individual investors do not. Our technical partnership allows clients to enjoy automatic trading strategies on their private wallets. This happens through a secure API that enables trades to execute directly on client accounts.

Learn about how to connect EndoTech to Coinbase Pro here.

Oil Live Pricing

FAQ

CL1:COM

Generic 1st ‘CL’ Future

77.91

Supply and demand for oil can lead to dramatic price fluctuations since it is a limited resource. Without owning any physical oil, there are several ways to trade oil.

There are three ways you can trade oil:

- Oil spot trading – refers to the cost of buying or selling oil immediately, or ‘on the spot’ – rather than at a future date. The spot price of oil is what it is currently worth, whereas futures prices reflect what the market believes oil will be worth when they expire.

- Oil futures trading – an oil futures contract requires you to swap a certain volume of oil at a specific price on a certain date. Buying and selling oil futures allows you to trade increasing and decreasing oil prices. Using futures, investors can lock in favorable oil prices and hedge against price fluctuations. The Intercontinental Exchange (ICE) and the New York Mercantile Exchange (NYMEX) are the two most prominent exchanges where Brent Crude and West Texas Intermediate (WTI) are traded. Both oil prices and economic health are influenced by them.

- Oil options – Oil options are similar to futures contracts in that you don’t have to trade if you don’t want to. An option gives you the right to buy or sell oil at a specified price on a specific date, but you are not required to exercise it. There are two types of options: calls and puts. Consider buying a call option if you expect oil prices to rise. Puts are worth buying if you think they will collapse. You can also sell call and put options if you wish to take opposing positions.

Yes you can. However, you can also lose money. Oil prices fluctuate dramatically and so there are added risks to investing in oil.

In 2008, oil reached its all time highs. On July 3rd, 2008, the price of a barrel of crude oil on the NYME reached an intraday high of $145.85, while Brent crude futures on the ICE Futures market reached $146.69. These are the all-time highs for oil prices. Prices later fell and moved downward throughout the day. WTI fell 2.65% to $107.67 per barrel, while Brent fell 2.19% to $110.46 per barrel.

Oil prices are often impacted by geo-political events. Going into 2023, two major factors can impact oil prices. A possible deal with Iran is seen as a potential for declining oil prices. And, Russia’s invasion of Ukraine has been exerting pressure on oil prices.

About 1.2 million contracts are traded daily for crude oil. In terms of market capitalization, Exxon Mobil has the highest market cap in the oil and gas industry. According to its October 17, 2022 earnings report, the U.S.-based company had a market capitalization of 410.22 billion dollars. Five of the ten largest companies are Big Oil companies.

CRUDE OIL BRENT has an average daily trading volume of 60,000 on the CME and ranks 263 by trading volume.

In the global economy, crude oil is one of the most important sources of energy. The price of crude oil is highly susceptible to geopolitical and meteorological factors, in addition to being one of the most actively traded commodities. Prices of crude oil are highly volatile and heavily influenced by consumer and investor attitudes in the global crude oil market, which is based entirely on investor expectations of supply and demand.