Ethereum (ETH) Bots & Live ETH Pricing

Institutionally-Proven Automated ETH Trading Algorithms

EndoTech Algorithms trade ETH and Deliver Results.

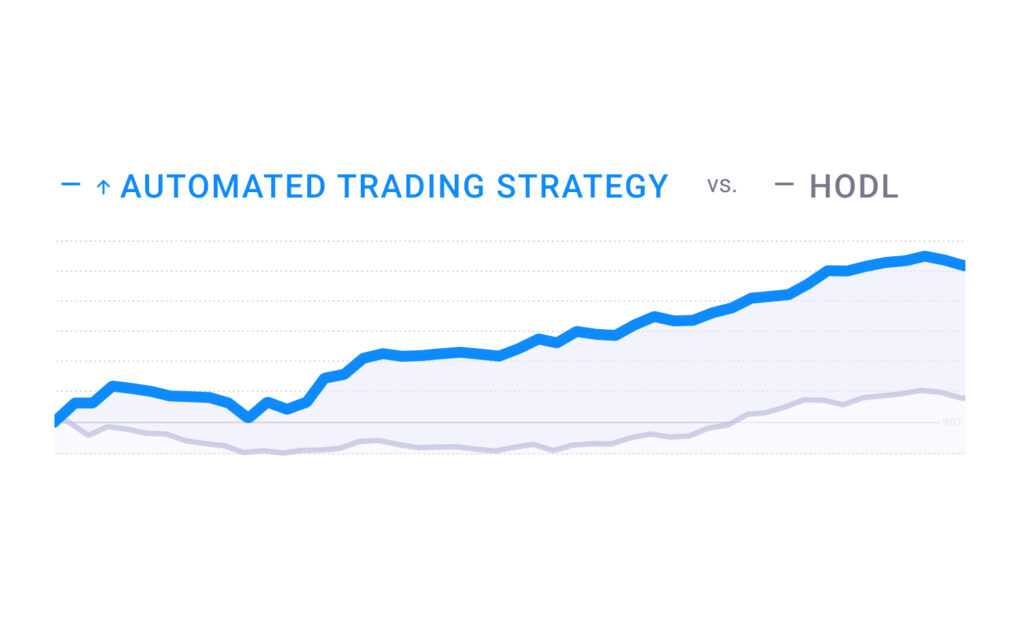

Clients use EndoTech’s automated trading strategies to get Alpha exposure from Ethereum (ETH) while enjoying proven risk management. Instead of a failed ‘buy and hold’ (HODL) approach, ETH trading algorithms deliver results securely on your own exchange wallet. Connect to the ETH trading strategy and trades are automatically executed on your account through a secure API.

Ethereum basics:

Ethereum (sign: E) abbreviated as ETH; is the second largest decentralized digital currency. ETH is renowned for being the building blocks of Web3 world For example, many other coins and contracts use the ERC-20 token standard developed in the Ethereum blockchain for their applications.

Ethereum trading bots:

EndoTech’s secure trading bots execute a series of proven trading algorithms that are based on ETH movements.

ETH Strategies Outperform HODL

HODL has been up and down.

Bots capture the movements and deliver better results

EndoTech ETH trading bots

EndoTech’s ETH trading strategies include a variety of trading styles and risk profiles including: ETH Long, ETH Long/Short, ETH Leveraged, ETH accumulating

- These use AI algorithms to determine the right time to enter or exit long positions.

- Many countries – including the US – only allow for these strategies.

- These leverage artificial intelligence to find the right time to enter long or short positions enabling trading in both bull and bear markets. These require futures trading accounts.

- These strategies include both long and short, or long only positions but bring leverage to amplify earnings and risk. Leverage requirements are set by various exchange partners.

- These strategies use AI algorithms with the goal of accumulating more ETH cryptocurrency.

How to choose the right bot for you?

A trading strategy is a high risk, high reward investment. You are invited to consult with our success team by setting up a consultation here or speaking with them via WhatsApp and Telegram

Choosing the right strategy is generally based on the following parameters:

- Risk/reward profile – Different strategies have different risk parameters. You should use risk capital only

- Capital requirements – How much capital is available and how much diversification

- Regulation – Different countries prevent clients from trading futures

- Crypto Exchange – Certain exchanges are better suited for different strategies. All EndoTech strategies list the exchanges supported

- Preference – Some clients have preferences for which coin to trade

How EndoTech works with...

EndoTech has a premier partnership with Binance and Binance.US. As such, we have access to service and support that individual investors do not. Our partnership is actively supported by Binance management as a leader in investment innovation. Technically, our trading algorithms use secure APIs to execute trade signals directly on client accounts and have no access to client funds.

Learn about how to connect EndoTech to Binance, Binance.US here

EndoTech has a deep partnership with Bitfinex. As such, our clients get service and support that individual investors do not. Our active partnership is rooted in the innovative algorithms that we bring to investors using their exchange. Technically, EndoTech’s trading algorithms use secure API connection to execute trading strategies directly on client accounts and have no access to client funds.

Learn about how to connect EndoTech to Bitfinex here.

![]()

EndoTech has a deep partnership with Coinbase Pro. With this partnership, EndoTech clients get premium service and support that individual investors do not. Our technical partnership allows clients to enjoy automatic trading strategies on their private wallets. This happens through a secure API that enables trades to execute directly on client accounts.

Learn about how to connect EndoTech to Coinbase Pro here.

ETH Live Pricing

FAQ

Ethereum (CRYPTO: ETH)

Ethereum can be bought using cryptocurrency exchanges. These exchanges enable clients to buy, sell, hold cryptocurrencies and Ethereum.

There is are wide choice of exchanges to buy Bitcoin. Popular centralized exchanges include Binance, Binance.US, Coinbase Pro, Gemini, Bitfinex. Most exchanges require that customers identify themselves through documentation.

Bitcoin can also be bought using PayPal, credit card or other means. For example, you can buy Ethereum at ATM machines or through P2P exchanges.

With the growth in cryptocurrency, Ethereum can also be bought through mainstream brokers like Robinhood and even more traditional banks.

You can make money with Ethereum and you can lose money with Ethereum. It should be with risk capital only.

Ethereum’s price volatility has been a challenge for many investors. While many have gone for a strategy of ‘holding on for dear life’ (HODLing), there are more advanced ways to invest in Ethereum.

The all time high for Ethereum is more than $4,800 in November of 2021. The price of Ethereum has moved significantly since, and is now trading at 1/4 of those prices.

As of Nov 20, 2022, the market cap of Ethereum was $149 billion dollars.

The 24hr trading volume for Ethereum is around 11.6 million Ethereum as of Nov 20, 2022.

There are 122 million Ethereum circulation as of Nov 20, 2022

Ethereum represents 17% of all crypto currency value (as of Nov 22, 2022). Ethereum seems to be the 2nd most valued cryptocurrency.