Bitcoin (BTC) Bots & Live Bitcoin Pricing

Institutionally-Proven Automated BTC Trading Algorithms

EndoTech Algorithms trade BTC and Deliver Results.

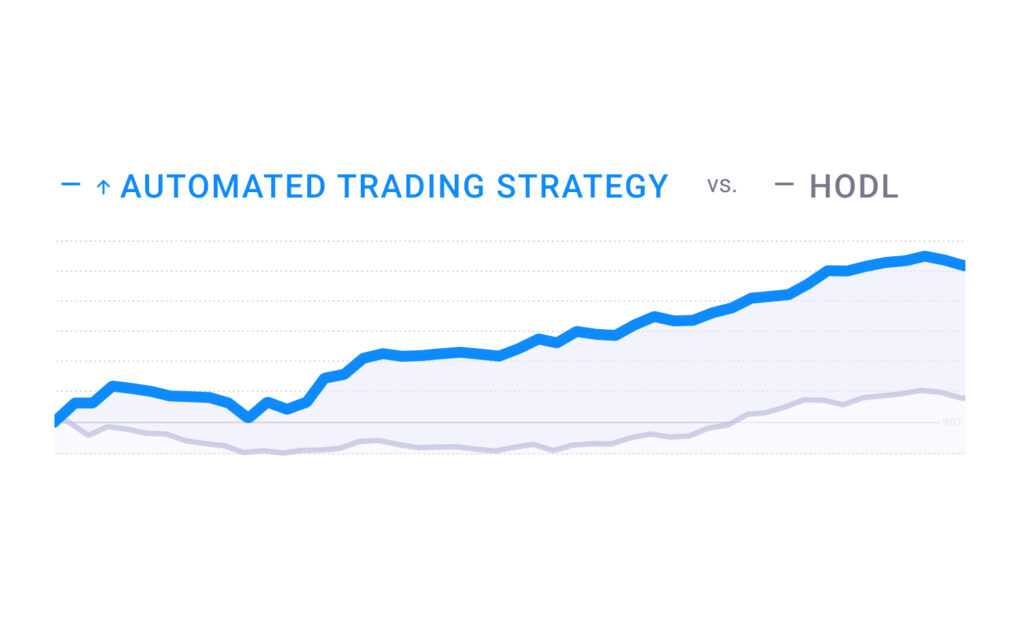

Clients use EndoTech’s automated trading strategies to get Alpha exposure from BTC while enjoying proven risk management. Instead of a failed ‘buy and hold’ (HODL) approach, BTC trading algorithms deliver results securely on your own exchange wallet. Connect to the BTC trading strategy and trades are automatically executed on your account through a secure API.

Bitcoin basics:

Bitcoin (sign: ₿) abbreviated as BTC; is the largest decentralized digital currency. BTC can be used in the peer-to-peer network and transactions are recorded on the blockchain – a verified digital distribution ledger. This was formed by Satoshi Nakamoto back in 2008.

Bitcoin trading bots:

EndoTech’s trading bots execute a series of proven trading algorithms that are based on BTC movements.

BTC Strategies Outperform HODL

HODL has been up and down.

Bots capture the movements and deliver better results

EndoTech BTC trading bots

- These use AI algorithms to determine the right time to enter or exit long positions.

- Many countries – including the US – only allow for these strategies.

- These leverage artificial intelligence to find the right time to enter long or short positions enabling trading in both bull and bear markets. These require futures trading accounts.

- These strategies include both long and short, or long only positions but bring leverage to amplify earnings and risk. Leverage requirements are set by various exchange partners.

- These strategies use AI algorithms with the goal of accumulating more BTC cryptocurrency.

How to choose the right bot for you?

A trading strategy is a high risk, high reward investment. You are invited to consult with our success team by setting up a consultation here or speaking with them via WhatsApp and Telegram

Choosing the right strategy is generally based on the following parameters:

- Risk/reward profile – Different strategies have different risk parameters. You should use risk capital only

- Capital requirements – How much capital is available and how much diversification

- Regulation – Different countries prevent clients from trading futures

- Crypto Exchange – Certain exchanges are better suited for different strategies. All EndoTech strategies list the exchanges supported

- Preference – Some clients have preferences for which coin to trade

How EndoTech works with...

EndoTech has a premier partnership with Binance and Binance.US. As such, we have access to service and support that individual investors do not. Our partnership is actively supported by Binance management as a leader in investment innovation. Technically, our trading algorithms use secure APIs to execute trade signals directly on client accounts and have no access to client funds.

Learn about how to connect EndoTech to Binance, Binance.US here

EndoTech has a deep partnership with Bitfinex. As such, our clients get service and support that individual investors do not. Our active partnership is rooted in the innovative algorithms that we bring to investors using their exchange. Technically, EndoTech’s trading algorithms use secure API connection to execute trading strategies directly on client accounts and have no access to client funds.

Learn about how to connect EndoTech to Bitfinex here.

![]()

EndoTech has a deep partnership with Coinbase Pro. With this partnership, EndoTech clients get premium service and support that individual investors do not. Our technical partnership allows clients to enjoy automatic trading strategies on their private wallets. This happens through a secure API that enables trades to execute directly on client accounts.

Learn about how to connect EndoTech to Coinbase Pro here.

BTC Live Pricing

FAQ

Bitcoin (CRYPTO: BTC)

Bitcoin can be bought using cryptocurrency exchanges. These exchanges enable clients to buy, sell, hold cryptocurrencies and Bitcoin.

There is are wide choice of exchanges to buy Bitcoin. Popular centralized exchanges include Binance, Binance.US, Coinbase Pro, Gemini, Bitfinex. Most exchanges require that customers identify themselves through documentation.

Bitcoin can also be bought using PayPal, credit card or other means. For example, you can buy Bitcoin at ATM machines or through P2P exchanges.

With the growth in cryptocurrency, Bitcoin can also be bought through mainstream brokers like Robinhood and even more traditional banks.

You can make money with Bitcoin and you can lose money with Bitcoin. It should be with risk capital only.

Bitcoin’s price volatility has been a challenge for many investors. While many have gone for a strategy of ‘holding on for dear life’ (HODLing), there are more advanced ways to invest in Bitcoin.

The all time high for Bitcoin is more than $69,000 in November of 2021. The price of Bitcoin has moved significantly since, and is now trading at 1.4 of those prices.

As of Nov 20, 2022, the market cap of Bitcoin was $318 billion dollars.

The 24hr trading volume for Bitcoin is around 1.1 million bitcoin, with a value of $18 billion dollars as of Nov 20, 2022.

There are 19.2 million Bitcoins in circulation as of Nov 20, 2022

Bitcoin represents 38% of all crypto currency value (as of Nov 22, 2022). Bitcoin seems to be the most valued cryptocurrency. It’s market cap more than doubles its nearest competitor, Ethereum.