We believe that as digital assets investing become mainstream, there will be an unparalleled advantage using algorithms to identify and act on out-sized volatility. For the foreseeable future, as throngs of new investors migrate to digital currencies, advanced tools that recognize market movements, and execute at scale will deliver significant alpha. We have algorithms to identify and capitalize on new digital markets.

EndoTech is a pure algorithmic long/short approach that captures the opportunities over long periods of time in high volatility markets with selective, but definitive market movements.

As more onramps formalize, digital utility increases and asset class stigmas subside, total tradeable will continue to grow exponentially

As retail investors onboard with simple, emotional trading, the advantage of AI-based algorithms will continue to grow

Driven by new coin launches, new digital applications, excitement for upsized returns and tumultuous regulatory environment

As developed tools like ETFs and algorithms simplify investment thesis, the market will seek a simplification of both trading and risk mitigation

As the market becomes inundated with fly-by-nights, as funds move into Crypto algorithms, they will ensure custody (SMA)

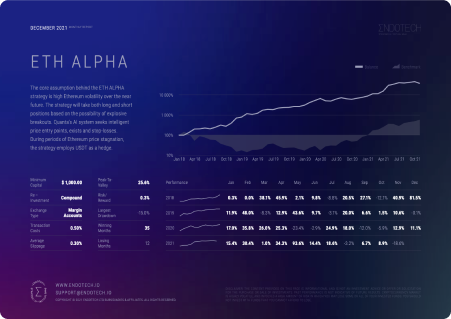

The core assumption behind the ETH ALPHA strategy is high Ethereum volatility over the near future. The strategy will take both long and short positions based on the possibility of explosive breakouts. EndoTech’s Al system seeks intelligent price entry points, exists and stop-losses. During periods of Ethereum price stagnation, the strategy employs USDT as a hedge.

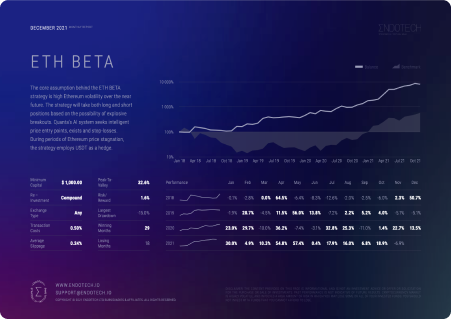

The core assumption behind the ETH BETA strategy is high Ethereum volatility over the near future. The strategy will take both long and short positions based on the possibility of explosive breakouts. EndoTech’s AI system seeks intelligent price entry points, exists and stop-losses. During periods of Ethereum price stagnation, the strategy employs USDT as a hedge.

The core assumption of the EndoTech BTC ALPHA strategy is continuous high-volatility of BTC in the near future, The strategy will take both long and short positions based on possible explosive breakouts, EndoTech’s AI systems look for intelligent price entry points, exits and stop losses, During BTC stagnation periods it uses USDT as a hedge.

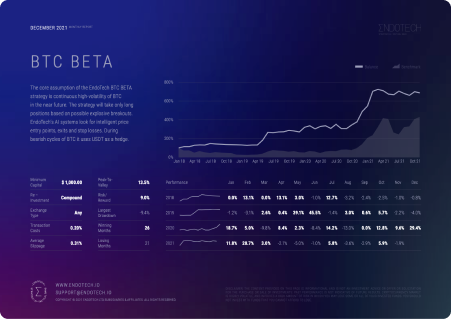

The core assumption of the EndoTech BTC BETA strategy is continuous high-volatility of BTC in the near future. The strategy will take only long positions based on possible explosive breakouts. EndoTech’s AI systems look for intelligent price entry points, exits and stop losses. During bearish cycles of BTC it uses USDT as a hedge.

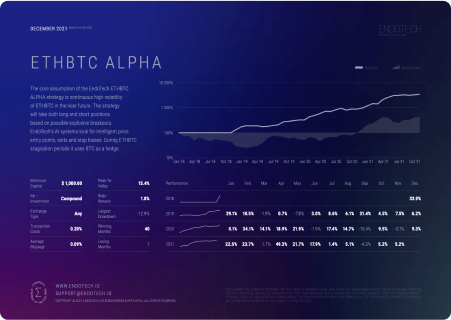

The core assumption of the EndoTech ETHBTC ALPHA strategy is continuous high-volatility of ETHBTC in the near future. The strategy will take both long and short positions based on possible explosive breakouts. EndoTech’s AI systems look for intelligent price entry points, exits and stop losses. During ETHBTC stagnation periods it uses BTC as a hedge.

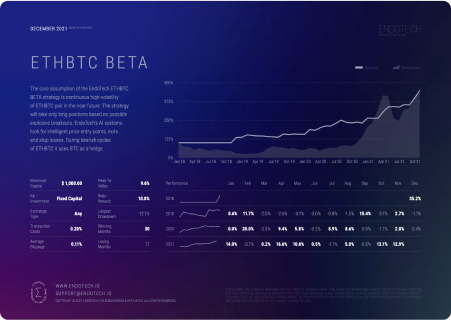

The core assumption of the EndoTech ETHBTC BETA strategy is continuous high-volatility of ETHBTC pair in the near future. The strategy will take only long positions based on possible explosive breakouts. EndoTech’s AI systems look for intelligent price entry points, exits and stop losses. During bearish cycles of ETHBTC it uses BTC as a hedge.

The core assumption of the EndoTech super strategy is continuous high-volatility of major pairs in the near future. The strategy will take both long and short positions based on possible explosive breakouts. EndoTech’s AI systems look for intelligent price entry points, exits and stop losses. During bearish cycles of the market it uses USDT and BTC as a hedge.

To discuss your institutional investment needs contact us here:

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN; IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM. ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK OF ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL WHICH CAN ADVERSELY AFFECT TRADING RESULTS.

Copyright ©2026 ΣNDOTECH. All rights reserved.