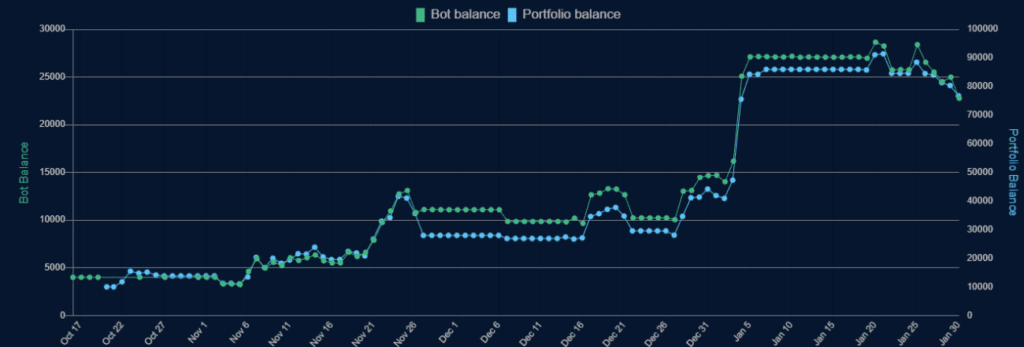

After a flawless consecutive three months of positive results, a large set of moves in January caused a full negative loss for 42 clients. These clients are limited only to those who joined the Hyper ETH Leverage X 10 strategy in January 2021.

Meanwhile, all our other strategies entered a “No Trading” zone by reflecting overly-high-risk ET-Volatility indicators.

However, on the Hyper ETH Leverage X 10 Alpha strategy, our same ET-Volatility indicator signaled that ultra-high-risk strategies could enter and start trading.

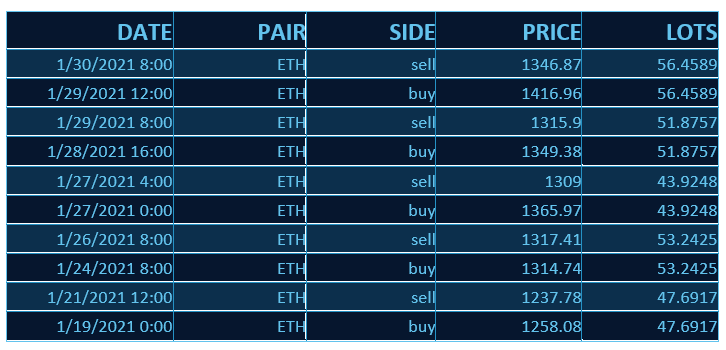

The table above showcases the five consecutive trades that resulted in a 90-100% loss for select clients.

Please note that this total loss scenario was only limited to new January clients. Any clients who joined before January have already realized returns ranging from 200-600%. In addition, since our money management is Fixed Principal, they lost 100% of the initial deposit, maintaining a fair 100-500% return overall.

Forty-two select clients lost the first “bullet” (principle) for the first time in the history of EndoTech.

Is this kind of loss likely to happen again? Yes. However, we endeavor to adapt, learn, and evolve further to improve results through this experience.

When is it likely to happen again? It could happen as soon as next month. Keep in mind that we are working to produce annual, long-term stable results. Statistical performance over time requires all participants to accept the highs and lows. As we have showcased repeatedly, a sequence of negative months represents the ideal time to increase or reload capital into connection to our strategies.

Should you join or rejoin this strategy specifically after such a loss occurs?

If you look for:

1. Ultra-high-risk, high-return strategies (100% loss and potential monthly returns of 1000% and up).

2. Trading with risk-loss capital (capital that you can afford to lose).

3. Having at least two “bullets” in your risk capital to continue.

4. Using 15% of your total risk capital at most for ultra risky strategies

Then Yes. For any who can no longer continue to answer affirmatively to the above, the answer is No.

We look forward to producing more outsized results alongside you. Thank you for your time and consideration.