Crypto markets returned 100% to 1000% over the last year. But after the recent market melt-down of 64% and amid a market struggling to find its reversal, we have been left with a few questions – namely, will we see such returns again?

And, if yes, can we limit our risk to some reasonable level like 25%?

Before we proceed with what, why, and how, I would like to make a statement. I’m optimistic regarding crypto markets. This is the first assumption one needs to make when investing in a young and volatile market. It rests on the idea that the market will grow and is not simply smoke and mirrors. I hope I’m right for several reasons. I love that this is the next innovative high-tech phase after a relatively long period of tech depression. I love blockchain technology’s attempt to provide solutions that protect parties – both B2B and B2C. Of course, I see a full range of good, bad, and ugly attributes, but overall, I love the energy and excitement of teams empowered to dream bold and big.

I want this market to succeed. For investors’ sake, I hope that this market will grow and mature. I’ve co-written this article on crypto-investing with Dr. Chiara Longo, Chief Economist of Pareto Network. While the version that appears in Dr. Longo’s blog is more suitable for beginners, we want to present a more detailed look at the subject here. If you are unfamiliar with Alpha/Beta terminology or find these concepts unclear – I would suggest that you read Dr. Longo’s blog first.

How To Build A Crypto Portfolio

We’ve found that the dynamics in this game are pretty new when building Crypto portfolios. The traditional methodologies and techniques that are thoroughly explained in standard finance handbooks do not necessarily work:

- Crypto assets’ prices are highly volatile; if we look, for example, at the recent history of b, its volatility has reached levels rarely seen in any market. In December 2017, Bloomberg reported that Bitcoin’s 10-day volatility rose to 125%, surpassing the 102% peak that the S&P 500 has seen only in October 2008, at the inception of the financial crisis.

- At this time, the correlations between assets are almost all very close to 1 and positive; this makes it very difficult to diversify a portfolio to minimize risk. The high degree of correlation may be attributable to several factors like a small set of currencies applied to most purchases, fairly standardized technologies behind the coins, and the likelihood that most “altcoin” buyers have rotated out of some of their gains in BTC and ETH. However, this correlative behavior might change in the future, potentially loosening the links between assets and inverting the relationships.

- Today’s crypto markets are still quite rigid and involve many constraints. For one, it involves assets that are not traded on all markets. Moreover, money transfers often require several business days, meaning that potential investors must immobilize their funds, so they are “ready when the time comes.”

Given the inefficient qualities of the crypto environment, the game is challenging – it’s still attractive, but the rewards are not that easily accessible, at least not yet.

At EndoTech, we are addressing the challenge of portfolio management by following the approach outlined below:

- Active rebalancing is our key. “Buy and hold” is not a valid approach in such a young market where the “power struggle” is still genuine, technologies are immature, and any cryptocurrency can quickly lose its value to another player. Monitoring and maintaining currencies in a manner that empowers you to properly rebalance your portfolio is crucial for minimizing risks while maximizing returns. This means keeping them on a reputable exchange or in a wallet that will enable you to transact quickly (we will expand on security more in a future post).

- Decide on what suits you best – whether Alpha or Beta portfolios. Will you be upset if you make just half of the market returns, or will you be more discontent if you see that two-thirds of your investment disappear.

- Rely on trading strategies to add assets to the portfolio to increase or decrease the share of an individual holding. Our EndoTech genetic analysis factory carefully chooses these strategies to provide adaptive technology for quickly evolving markets.

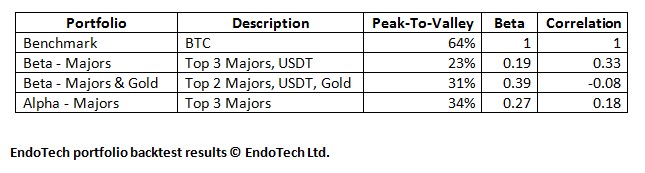

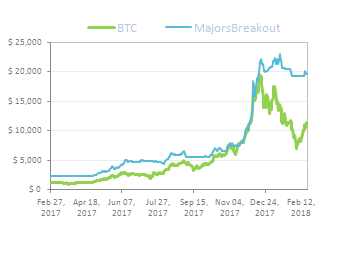

Now, for the exciting part – results! Below, we highlight our results from an initial set of portfolio allocation systems developed by EndoTech. Yes, they are backtested results. We are not financial advisors, and we are not recommending you follow this system. While we share what we found to work in such markets, we cannot guarantee that it will work in the future.

These results are exclusively based on backtesting. Historical performance is not indicative of future results or price behavior.