Gold Trading Bot & Live Gold Pricing

Institutionally-Proven Automated Gold Trading Algorithms

EndoTech Algorithms to trade Gold and Deliver Results.

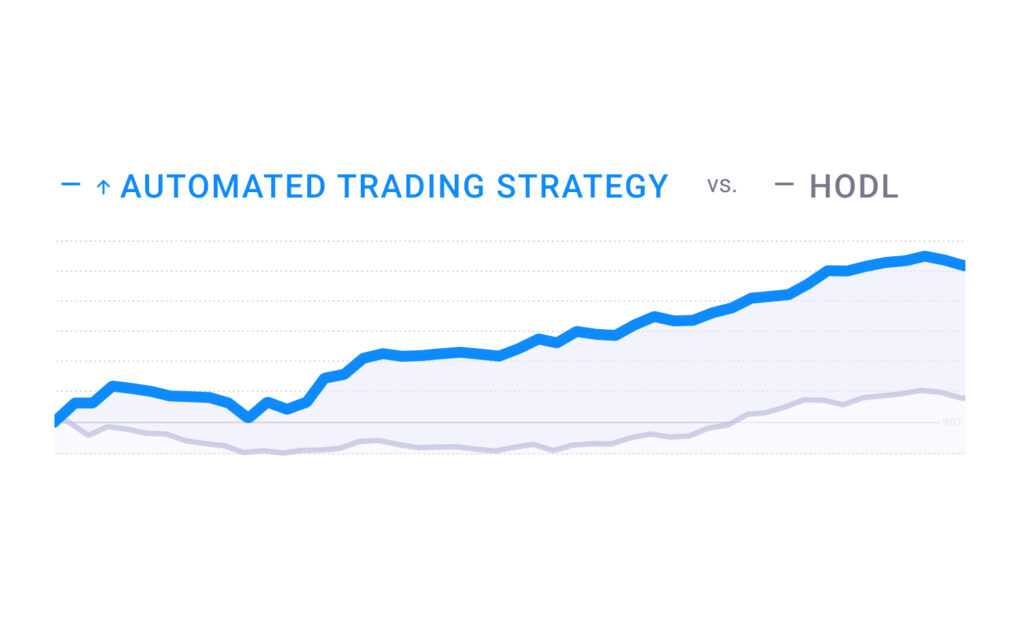

Clients using EndoTech’s automated trading strategies to get Alpha exposure while enjoying proven risk management. Instead of a failed ‘buy and hold’ (HODL) approach, Gold trading algorithms deliver results securely and automatically. Imagine the power of connecting to the Gold trading strategy that trades automatically executed on your account through a secure API.

Gold Trading Basics:

Gold trading is the buying and selling of gold, either as physical gold or as paper gold. It is an important part of the global economy, as it is used to hedge against inflation and is a major form of investment.

The two primary ways of trading gold are spot gold and futures gold. Spot gold refers to the current price of gold, while futures gold is an agreement to buy or sell gold at a fixed price and date in the future. When trading gold, traders will look at the supply and demand of the metal and economic conditions to determine the best time to buy and sell.

When trading gold, investors can buy physical gold, such as coins and bars, or they can buy paper gold, such as ETFs, gold certificates, and futures contracts. Each type of gold has its own advantages and disadvantages. Buying physical gold provides investors with the security of actually owning the metal, while paper gold provides more liquidity and is often cheaper to purchase.

When trading gold, traders will look at the gold price, which is determined by the global market. Gold prices can be affected by factors such as geopolitics, the economy, and supply and demand. Traders will also look at technical indicators to make informed trading decisions, such as analyzing the trend of the price of gold, the relative strength index (RSI), and the moving average convergence divergence (MACD).

Gold trading is a complex and risky activity but can be a great way to diversify an investment portfolio and hedge against inflation. It is important to do research and understand the risks before investing in gold.

Gold trading Algorithm:

A gold trading algorithm is a computer program designed to automatically execute trades on the gold markets. It is designed to track the price of gold, execute buy and sell orders, and manage risk. Gold trading bots are typically used by traders who are either too busy to monitor the markets manually, or by those who are not experienced enough to make manual trading decisions. The algorithm monitors the markets for buying and selling opportunities, and executes trades according to predetermined rules. It can also be programmed to take advantage of short-term market movements and to set stop losses, take profits, and adjust leverage. The use of a trading algorithm does not guarantee profits, but can help traders to reduce risk and maximize returns.

Gold Trading Algorithms Outperform Buy and Hold

Gold strategies outperform ‘Buy and Hold’ in several ways. First, gold strategies are able to take advantage of market volatility, which can be a major benefit in times of market uncertainty. Gold strategies also allow investors to diversify their portfolios and hedge against inflation by investing in multiple assets. Furthermore, gold strategies can provide investors with greater liquidity and lower risk than ‘Buy and Hold’. Gold strategies are also able to take advantage of global trends, such as the weakening of the US dollar. Finally, gold strategies can provide investors with higher returns than simply buying and holding over the long term.

How to choose the right algorithm for you?

A trading strategy is a high risk, high reward investment. You are invited to consult with our success team by setting up a consultation here or speaking with them via WhatsApp and Telegram

Choosing the right strategy is generally based on the following parameters:

- Risk/reward profile – Different strategies have different risk parameters. You should use risk capital only

- Capital requirements – How much capital is available and how much diversification

- Regulation – Different countries prevent clients from trading futures

- Exchange – Certain exchanges are better suited for different strategies. All EndoTech strategies list the exchanges supported

- Preference – Some clients have preferences for which coin to trade

How EndoTech works with...

EndoTech has a premier partnership with Binance and Binance.US. As such, we have access to service and support that individual investors do not. Our partnership is actively supported by Binance management as a leader in investment innovation. Technically, our trading algorithms use secure APIs to execute trade signals directly on client accounts and have no access to client funds.

Learn about how to connect EndoTech to Binance, Binance.US here

EndoTech has a deep partnership with Bitfinex. As such, our clients get service and support that individual investors do not. Our active partnership is rooted in the innovative algorithms that we bring to investors using their exchange. Technically, EndoTech’s trading algorithms use secure API connection to execute trading strategies directly on client accounts and have no access to client funds.

Learn about how to connect EndoTech to Bitfinex here.

![]()

EndoTech has a deep partnership with Coinbase Pro. With this partnership, EndoTech clients get premium service and support that individual investors do not. Our technical partnership allows clients to enjoy automatic trading strategies on their private wallets. This happens through a secure API that enables trades to execute directly on client accounts.

Learn about how to connect EndoTech to Coinbase Pro here.

Gold Live Pricing

Gold price by GoldBroker.com

FAQ

XAU:CUR

Gold Spot $/Oz

1,817.6300XAU

Buying & investing in gold doesn’t require you to build a tiny safe full of gold and hold it in your home. In fact, the only storage you may need is an investment account.

Here are five different ways to own gold and a look at some of the risks that come with each.

- Gold Bars or Coins – often referred to as bullion, is owning the physical asset. One of the most common ways to buy it is through bars or jewels. Of course, it has sentimental and emotional value. However, buyers of physical gold rely 100% on the commodity’s price rising to make a profit. Unlike business owners (such as gold mining companies), these companies are able to produce more gold and therefore make more profits, thereby driving higher investment.

- Gold futures – in addition to physical delivery of gold, you can also speculate on gold’s price moving upwards (or downwards) with gold futures. Futures offer the greatest leverage when it comes to investing in gold. This means you can own a lot of gold futures for relatively little money. Futures on gold represent both opportunity and risk. For example, if gold moves against you, you will need to put up substantial amounts of money to maintain the contract (called margin) or the broker will close the position and you’ll lose money. Consequently, the futures market can allow you to earn a lot of money, but it can also lose it as well.

- ETFs that own gold – a great alternative to owning physical gold is to invest in an exchange-traded fund that tracks the commodity. An important advantage of owning an ETF over bullion is that it’s more easily traded for cash. Just like stocks, you can trade the fund any day the market is open. Of course this has its own risks. The ETFs expose you to gold’s price, so if it rises or falls, the fund should perform similarly, minus the fund’s costs. The ETFs, however, allow you to protect your gold and ensure full value for your holdings without the risks associated with owning the physical commodity.

- Mining stocks – gold mining businesses are another way to benefit from rising gold prices. These companies allow you to profit indirectly from gold’s value fluctuations. In this case, gold offers investors two viable ways of profiting. The company’s profits rise when gold’s price rises. Second, the company may increase production over time, giving them a double whammy. Of course, the risks associated here now include the business management – not just the value of gold. Choosing a reliable business is crucial because there are many risky ones out there. Lastly, mining stocks can be volatile, just like all stocks.

- ETFs that own mining stocks – since these funds are diversified across the sector, you won’t be hurt much from an underperformance of any single company. These funds offer the advantages of owning individual companies with the safety of diversification. Risk: Some funds have established companies, while others have junior mining companies, which are more risky.

Gold has always been seen as having intrinsic value. It is also seen as a speculative asset. With investor trust in financial institutions shaky after the 2008 catastrophe, gold provides an alternative to equities and shares or government bonds. The global pandemic in 2020 and 2021 resulted in massive money printing and an increase in national debt. Gold has once again become a popular investment option for those looking to hedge against inflation in the coming years.

Although long-term wealth protection is frequently the primary aim of investors, gold may be used to create money in the same way that equities and shares can.

Gold has traditionally been regarded as a repository of wealth, and the gold price generally rises during stormy times as investors seek refuge in this safe-haven commodity.

So far, the twenty-first century has been dominated by bouts of economic and societal unrest. Uncertainty has driven the precious metal to new highs as market investors seek its perceived security. And every time the gold price climbs, there are requests for even greater record-breaking heights.

On March 8, 2022, gold reached its highest price of $2,074.60 USD. While some believe gold will break US$3,000 per ounce and rise to US$4,000 or US$5,000, others believe US$8,000 or even US$10,000 gold will become a reality. These price forecasts have investors wondering, “What are realistic prices for gold in the future?”

The overall market capitalization of gold is around $11.34 trillion.

But how does that impact investors? Precious metals such as gold and silver provide several advantages to commodity investors, but they are not simply appealing as inflation hedges.

Many external elements that might impact investments. This can impact

- Investors sentiment

- The relative demand for gold – is it increasing or declining.

- The mathematical foundation for making investment decisions.

The equivalent of roughly 27 million ounces of gold are traded every day in the world’s top benchmark gold futures contract.

The highest estimates currently available show that around 205,238 tonnes of gold have been mined throughout history, with approximately two-thirds extracted since 1950. And, because gold is essentially indestructible, practically all of it is still around in some form or another.

The majority of the gold has originated in only three countries: China, Australia, and South Africa. In recent years, the United States ranked fourth in gold output.

For thousands of years, people have used gold as a kind of value storage. It also has practical applications in jewelry and electronics, which give it more intrinsic value. And unlike fiat money, the quantity of gold is somewhat constrained and acts as a hedge against inflation.

These factors have led to gold’s long-standing reputation as a refuge asset and inflation hedge. The problem is that there is conflicting evidence about how effective gold is as an inflation hedge.