The title above reflects one of the most accurate phrases ever published on social media. Most of us have experienced that bear market punch to the stomach at least once during our days of active trading. Still, before I start writing about how amazing, unique, and revolutionary our product is, I’d like to tell you a bit about my dog Gareth.

Between November 2017 and mid-January 2018, I had a portfolio named after Gareth and bought Dogecoin as a joke. Delightfully, that joke yielded a massive return, which I realized and spent on Gareth — I mean, come on, he’d earned it! The point of my silly (but true) story is that when markets rise, and the trend is bullish, even a dog can realize returns. But what happens when the market falls? This is where things get interesting.

EndoTech shifted its focus of operations to the cryptocurrency world in late 2017, united by its founders’ simple goal: to create a revolutionary product that would allow anyone to trade with confidence, with or against the market, no matter which group of traders they belonged to.

Essentially, the trading and investing community can be divided into three groups:

Alpha Traders: Alpha traders want to conquer the world. Their behavior illustrates a classic case of the fear of missing out (FOMO) — they’d capitalize on every single movement if they could, regardless of whether the market goes up, down, or sideways.

Beta Traders: Beta traders comprise a traditional group of FOL (fear of losing) traders. They enjoy returns when the market goes up and sit tight when the market falls.

Hodlers: A hodler is the most passive kind of trader. Hodlers simply invest and hold, regardless of what the market does. Hodlers stay loyal to their initial investments in crypto markets – holding and hoping for that 10x return.

(There is also a fourth group of traders/investors, called Super-Alphas. See a detailed description from our CEO, Dr. Anna Becker)

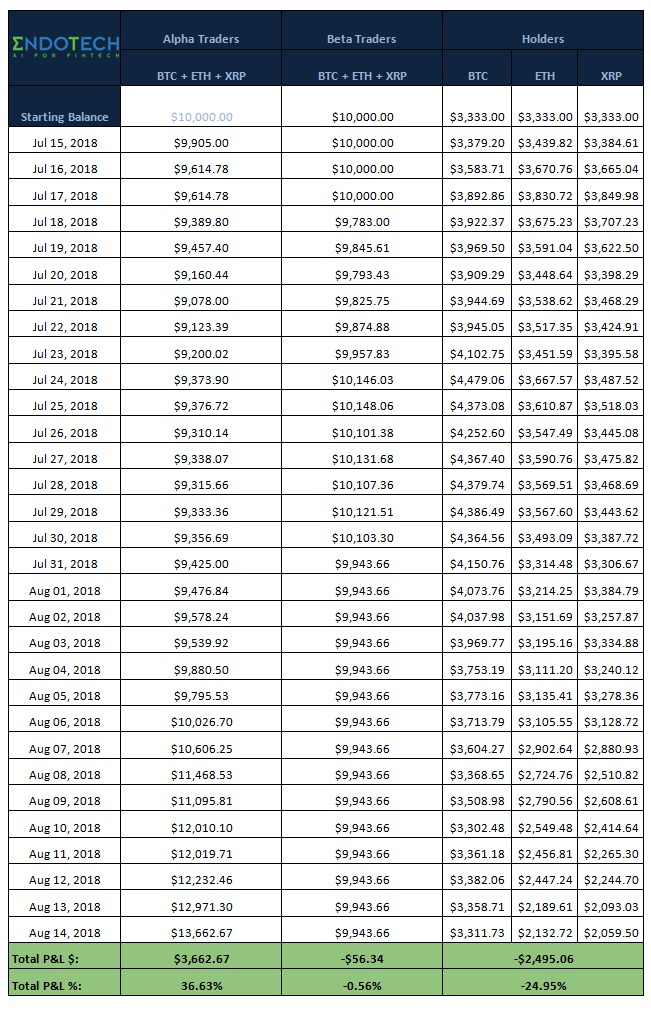

The following data offers a 1-month comparison between the three main groups outlined above from 15.07.2018 to 14.08.2018 when we deployed our AI and ML product across the three major coins, BTC, ETH & XRP.

According to this data, an Alpha trader would have grown their portfolio by a whopping 36.63% during this period. A Beta trader would have remained almost flat with only a 0.56% loss during the same period, while a hodler would have suffered a steep 24.95% loss. The test highlights that substantially different results unfolded among three different groups over the same amount of time and market conditions.

Now let’s return to my original question: ‘What happens when the market falls?’ The answer is quite simple — apply EndoTech! As an Alpha or Beta trader, you probably would’ve enjoyed a positive return, or at least remaining flat during a single month when hodlers lost 25% of their portfolios.

We are currently releasing signals every eight hours, creating a dynamic strategy while systematically working to reduce losses by a factor of three. Visit us today at EndoTech.io for more information about how our revolutionary AI and ML methodology works in fintech!