A Definitive Study on the Trends and Attitudes for Retail Crypto Investing

Table of Contents

Executive Summary

The crypto industry continues to develop at a remarkable pace. With continued volatility, new legislation and technological breakthroughs, there is much anticipation around the maturing of the industry. However, an implosion of crypto valuation, shady business practices and cases of bankruptcies have impacted not only coin valuations, but also investor

confidence.

So what’s next for the crypto investing and crypto investors?

In this landmark survey, we explored dozens of parameters for more than 1,000 American retail investors. Together, they paint a picture of maturation but also ‘growing pains’. As an industry, it’s important to take stock of not only coin values, but also investor confidence and trust. These are just some of the themes the survey report sheds light on.

Introduction

As investors move into a post-covid reality, they are faced with a severe drop in the traditional equities market, soaring inflation and a noisy, depressed crypto environment.

As total crypto market cap hovers around 1 trillion dollars – down from its 3 trillion high, this survey revisits the fundamental premises, motivations, drivers and obstacles for continued investor confidence.

With a dreary crypto 2022 coming to a close, and 2023 on the horizon, this survey report takes a sobering look into how much more work the crypto industry has ahead.

Key Takeaways

- Retail crypto penetration seems to be flattening

- The market is still weighted towards young males

- Prime motivations for investing remain profit and support for DeFi as a concept

- Despite the valuation erosion, investors are still interested in the market

- Despite this, many feel that there is a lack of trust

- Specifically, retail investors feel there is a strong need for regulation and better business controls with most believing that regulation should come from within the traditional financial system

- Retail investors also believe overwhelmingly that creators should be held legally accountable for their actions

- Security and fraud are still salient issues, but less pronounced

- Earning expectations are high and have not been met

- The environmental impact of crypto is a concern

- Investors are willing to take on more risk, if they have tools to guide them

Survey Methodology

The survey was conducted on more than 1,000 Americans the week of September 21st, 2022. The survey was conducted through anonymized polling and captured insights from a representative sample of both crypto investors and non-investors. Further questions were brought to over-sample of investors to allow for further exploration of crypto subjects. It has a margin error of 2% with a confidence level of 95%. The survey represents a cross section of age, gender and investment backgrounds.

FINDINGS

Retail Crypto Penetration Seems to be Flattening

While the crypto market excitement of 2021 showed an incredible uptick in the number of American wallet holders, the current retail environment is much more subdued. The reality of an elongated “crypto winter”, regulatory uncertainty, and well-publicized crypto failures like Voyager, Celsius and 3 Arrows has caused a decline in the interest of new retail participants.

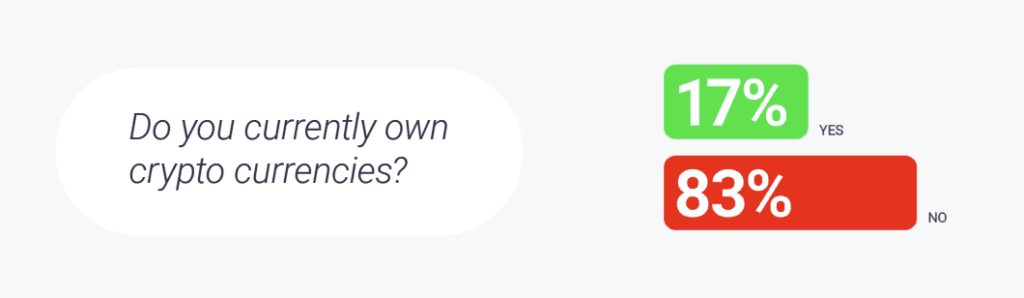

17% of Americans own cryptocurrency

It’s no surprise that as many markets have retreated, the percentage of Americans owning cryptocurrency has flattened, at 17%.

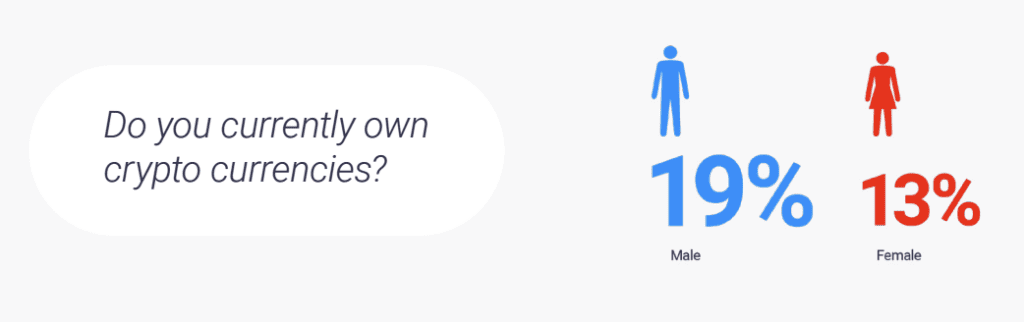

Men are more likely to own cryptocurrency than women

We continue to see that crypto penetration remains stronger amongst men than women. Our survey found that 19% of American men owned crypto currency, while only 13% of women do.

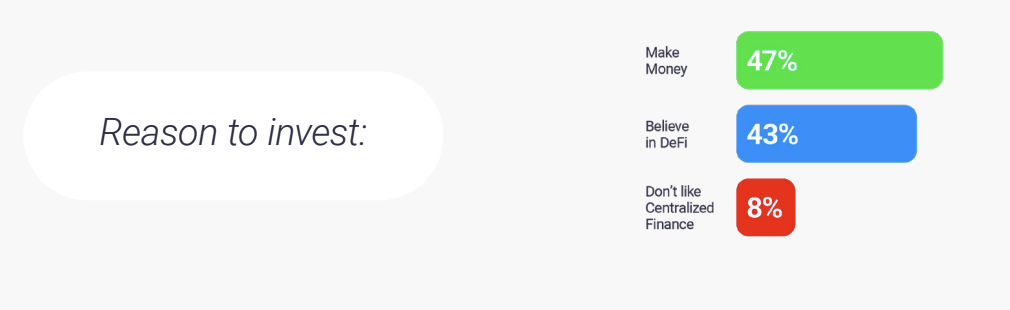

Crypto investors are primarily motivated by profits

While crypto purists have always backed DeFi for its principles and technology, we can see that the average investor is much more interested in the profit potential. 47% are invested in crypto because of the profit potential – even after the general retreat of valuations. Another 43% are invested in crypto because of the fundamental promise of decentralized finance. Another 8% view their crypto investments as more of an ‘anti’ movement – rejecting the principles of traditional, centralized financial institutions.

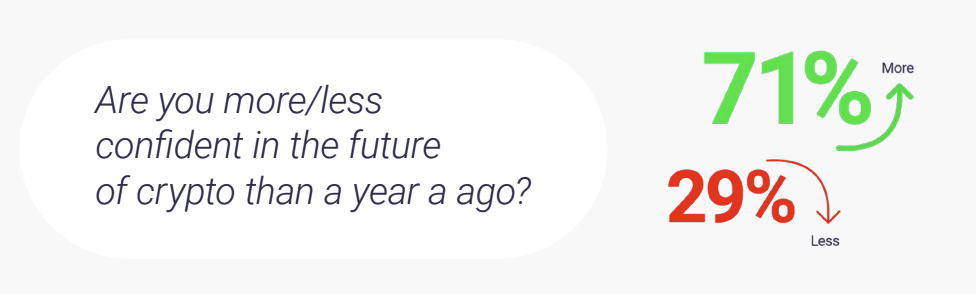

Investors are more confident in crypto than a year ago

Remarkably, despite the pronounced valuation erosion, investors surveyed are more confident in the long term future of crypto currencies than last year. One might imagine that having weathered endless volatility, and now making regulatory and technological inroads, investors believe that the asset class is well on its path to maturation.

Investors still have a general lack of trust

60% of those surveyed feel there is a lack of trust in cryptocurrencies. This general lack of trust expresses itself in two noteworthy ways.

First, despite the promise of blockchain providing a higher degree of transparency, people have yet to realize this transparency. And, more interestly, investors are eager for governments to regulate cryptocurrencies – something that is counter to some of the purists’ views of what DeFi should be.

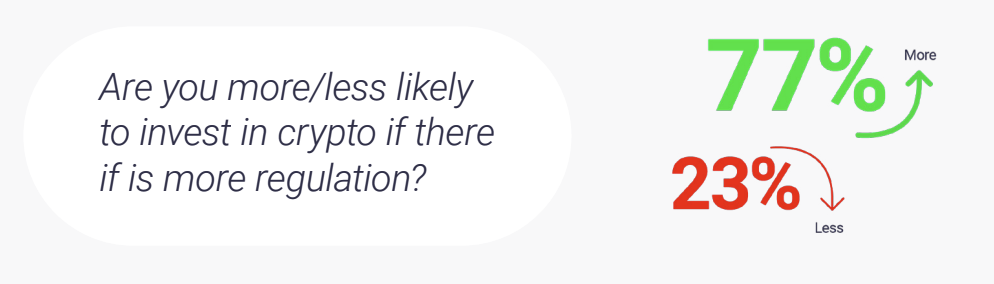

Investors are more inclined to invest if there is more regulation

77% of those surveyed claim that they’d be more inclined to invest if there was more regulation. This certainly points to a desire to have more guidelines and transparency on investing. This push to treat DeFi like centralized finance seems antithetical to many people’s attraction to crypto currency as a whole – that they are self – regulated and fully transparent.

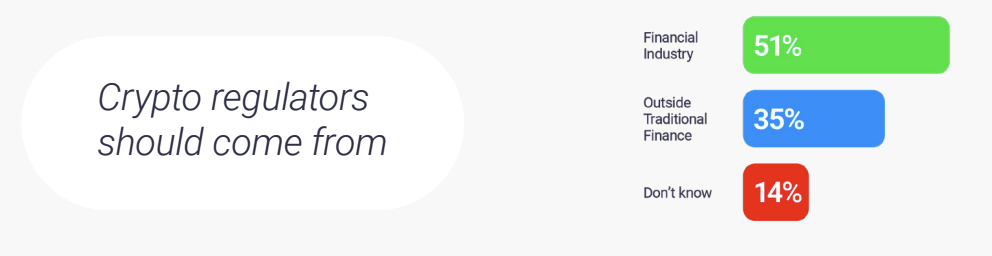

Investors expect regulators to come from traditional financial arena

51% of those surveyed envision current financial regulators like the SEC and CFTC to lead the continued regulatory processes for DeFi. This, again, points to the ‘mainstreaming’ trend we see retail investors seek. They are pushing for the regression to the financial constructs they are familiar with. This number lines up with the group of investors that are primarily motivated by profits.

However, 35% state that a regulator should come from outside traditional finance. This number aligns with the number of investors who are more principled with their DeFi driven investing.

Investors are mixed on recommending crypto to friends

In 2021, crypto’s meteoric rise was driven by endless tweets and telegram messages. This social tidal wave brought new investors and valuation to crypto.

However, this survey shows that despite the enthusiasm surrounding the profit potential, and the growing confidence in the maturation of crypto, it appears that the realities of poor results and concerning transparency is dissuading investors from ‘spreading the gospel’.

Only 47% of those surveyed said that they would recommend investing in crypto to a friend.

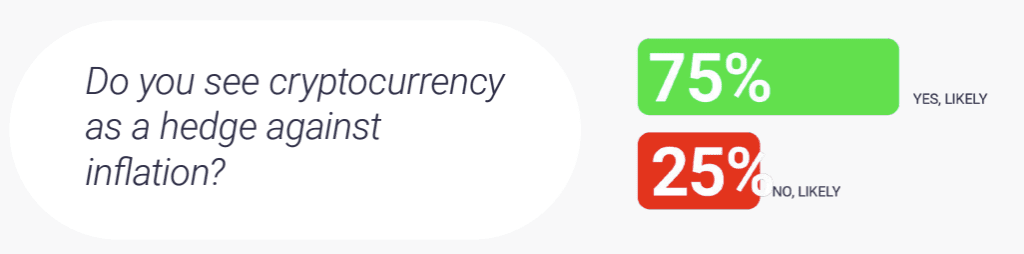

Investors overwhelmingly see crypto as an inflation hedge

With inflation news rampant in Q3, it’s no wonder that three quarters of those surveyed see crypto as a hedge against roaring inflation. At the time of the survey, international reports of predicted inflation above 20% in UK made the news, while the US Federal Reserve continued to raise interest rates to fend off roaring inflation above 8%.

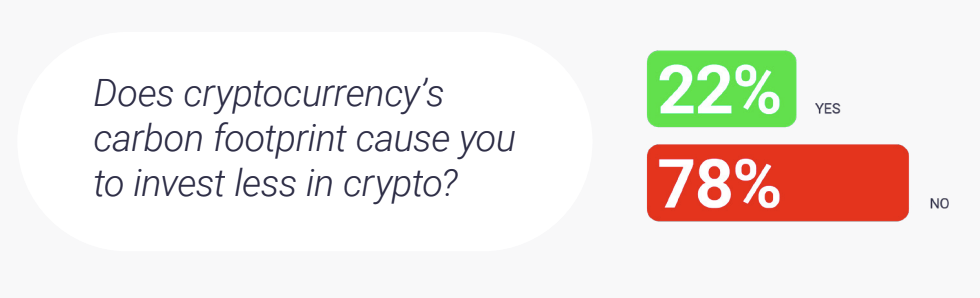

Externalities of environmental damage does play a role for investors

With the Ethereum Merge underway in September, the environmental footprint of crypto currency stole many headlines. When asked about the degree of worry crypto mining has in relation to the energy used, 34% said it did worry them.

This environmental concern may have an impact on investors’ appetite, with 22% of respondents declaring that they invest less because of it. Of major interest is how Ethereum’s promise of PoS vs. PoW impacts both energy consumption and environmental perception.

Crypto investors’ profit expectations have been unrealistically high

Given the primary motivation for investors is profit, it’s interesting to see how investors’ profit realization aligns with their expectations – especially after 9 months of persistent price erosion.

94% of investors expected to make more than 20% returns on their crypto investments. Of the surveyed population of crypto investors, 41% expected to earn more than a 50% return. Of course, these expectations seem unreasonably high today, but based on the returns generated for investors just a short year ago, these investments would have been very much possible.

Crypto investors lost a significant amounts last year

Unsurprisingly, 29% of crypto investors have lost more than 50% of their money. And, a further 45% claim to be around flat relative to their investments. While these declared statistics are above the industry benchmark, they can reflect investors that were ‘early in’ the market. So their investments predate the 2021 bubble.

Investors continue to have a risk appetite

By now, crypto investors are familiar with both the potential rewards, and the risks in the crypto market. And, given the outsized role that volatility and risk plays in this market, 54% of investors would be willing to take even more risk, if they had better investment and risk management tools.

This message is a clear opportunity for retail technologists. Investors are ‘eyes wide open’ to the opportunity in the market, and are eager for tools to manage their risk.

SUMMARY:

Summary: Investors see opportunity in a rebuilt crypto market

As investors look ahead, the same opportunity exists in the market – profit. They see that regulation, environmentally responsible actions and advanced risk management tools can pave the way to realize more of their profit goals.

Despite inflated profit expectations, investors see the industry in a stable state and are split on whether they would encourage loved ones to participate.

It’s exactly that split that is felt in the market now. Is this a lull before the next storm, or have we made enough headway that we can build on a more consistent upswing?

About EndoTech

EndoTech helps retail and institutional investors harness the power of AI algorithms to capture, manage and capitalize on market volatility. Through EndoTech, hundreds of thousands of investors have found they can tap the power of institutional grade solutions, previously only accessible to quant hedge funds and large institutional investors, to deliver high ROIs rooted in the interplay between different crypto currencies; exploiting the potential of this market in a way that runs counter to the emotional approach of typical buy and hold investing.