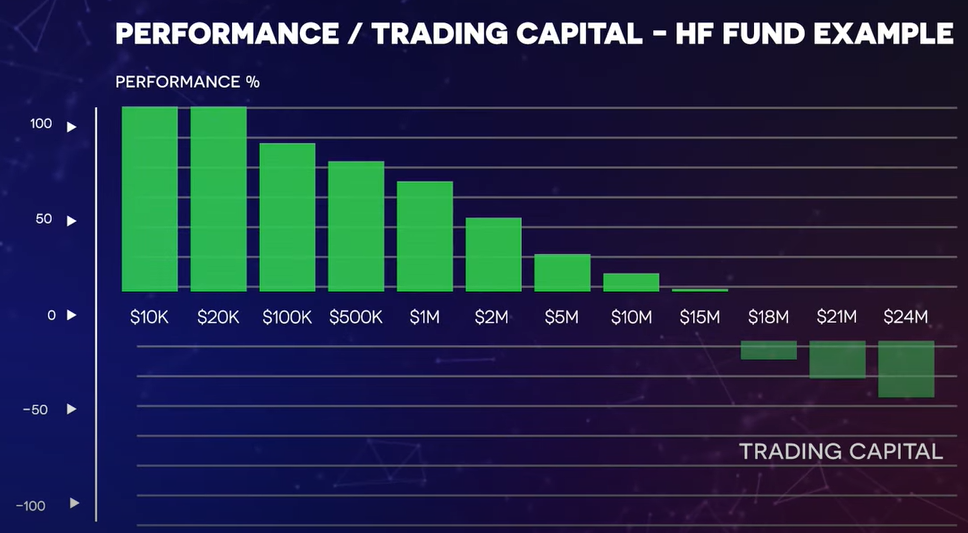

From our previous article or Youtube video, you may know that there are two important questions that irritate model developers. People are asking what will happen if everybody joins one strategy. Instead, the true question is what happens to the model performance if it trades large volumes.

The model performance moves the opposite to the scale of the trading capital. The reason is the larger the size of each order, the lower execution quality we get. If we reduce every order’s execution price by only one point the result will dramatically change. And the model will degrade from a profitable to a losing one.

This statement provokes 5 questions why, let’s delve into them.

#1 Why model performance declines if order size grows ?

When it comes to execution in financial markets, there are two possible ways to get the original price. Either as a market taker either as a market maker.

On one side, we have buyers who place their orders and want to buy at certain prices, meaning give U.S. dollars and get Ethereum in return. On the other side, there are sellers who want to sell at certain prices, give Ethereum, and get U.S. dollars in return.

If I want to buy at a price of $100, it means that each ETH should cost me $100. To buy 10 ETH, I need to pay $1,000. So I pay $1,000 to the first seller who has 75 ETH, and the seller gives me 10 ETH in return. Then this seller waits for someone else to buy the remaining 65 ETH.

But what if I manage not $1,000 but a $10,000 fund. It is enough money to buy 100 ETH at the price of $100. But there is only 75 ETH available at this price. And I will need to buy the remaining 25 from a seller at a price of $101. That is how our average execution price becomes $100.25 and not $100.00. And if my system wants to manage $100,000, the model performance can potentially move the market even further.

At EndoTech we are a market taker. We monitor the market and spot how much it can take without our orders affecting the price. And we repeat such small orders again and again till full order sizes are filled.

Our algorithm entries are done when the market is moving sideways prior to the move. And our exits are happening prior to the trend move completion. Thus we can use this smart market taker technique of our model performance.

#2 Why entry order does not improve execution of exit order?

Here is an example of GameStop stock price’s social media-induced spike in 2021. It was a clear case of a large order or a large number of small orders moving market price resulting in a further avalanche of movements because of all stop-orders triggered during the climb.

Why does not EndoTech want to play such a game?

Foremost, we are not interested in manipulating the markets. We are strictly here to participate. Also, to manipulate the markets one needs to have either a strong political stance on what is right and what is wrong or be insanely hungry for money. We are neither.

#3 Why do some companies succeed in investing and trading immense amounts?

Diversify. Diversify. Diversify.

The answer is the diversification of strategies, of strategy versions, of small orders series, of time-weighted average price execution, of assets and asset classes, of exchanges, etc.

#4 Why you are not afraid to reach capacity?

EndoTech is extremely good at diversifying and scaling up since we are a strong technological company. Plus when it comes to the frequency of the orders our principle of less-is-more does wonders with capacity issues.

#5 What is your performance curve, and if your system is so good why would you sell it instead of using for yourselves?

The crypto market is exhibiting approximately 100 billion dollars in daily transaction volume. It is large enough to digest up to 1 billion dollars in trading turnover. This means in the crypto market we are able to manage up to 1 billion dollars. After the next planned diversification, we will be able to manage up to 5 billion dollars, and then we will diversify in traditional markets.

Small investor’s perspective

When a regular client asks why we sell our system instead of using it for ourselves, s/he’s questioning why someone would share such a superpower. It usually happens after his/her $4,000 account turns into $8,000 and even into $65,000*.

Actually, we do trade for ourselves.

One of EndoTech’s test accounts is a perfect example. It started in 2020 with $125,000. Now it grew to 1 million dollars by trading on our ETH strategy. +700% profit is not bad, right?

Meanwhile, EndoTech already has 170 million dollars under the management of our strategies. And given any reasonable performance of +100% in the same year, we will theoretically earn $34M. There is a significant difference between 1 million dollars and 34 million dollars profit.

By 2022, the test account will grow to say $10M. At the same time, we plan to cross 1 billion dollars under the management of our strategies, which means by January 2022 we will generate 200 million dollars profit for the company.

Accordingly, by sharing our strategies with others, we win and we also share the rewards creating a meaningful relationship between both parties.

Large investor’s perspective

The same question has another form when it comes from large investors. If they would provide EndoTech with 1 billion dollars, why not trade it as a proprietary internal nostro fund?

The answer is the financial field is full of moral dilemmas. It is almost a zero-sum game. It is about which side you serve, and no one seems to be on the side of small investors when it comes to delivering high-return opportunities.

Despite that doing the right thing is always harder, it is also extremely gratifying!

Honestly, it is so much easier to make money for yourself. It is easier not to hold responsibility before small investors. It is easier not to listen to frustrated clients assured they can do better. Or communicate with newly joined clients who struggle to recognize the principles of long-term investing and thus consider one week of negative results a disaster.

We learn to see the big picture. In the end, we do deliver 2X and even 20X to our clients.

And indeed, there are risks.

Indeed, there are technological challenges.

Indeed, there is a learning curve.

But most importantly, we feel extremely satisfied that we do it not only for ourselves but for hundreds of thousands of clients.

And I thank our clients for being with us on this journey!

*Past performance, real or hypothetical, is not indicative of future results. There is a risk of loss in virtual currency trading.