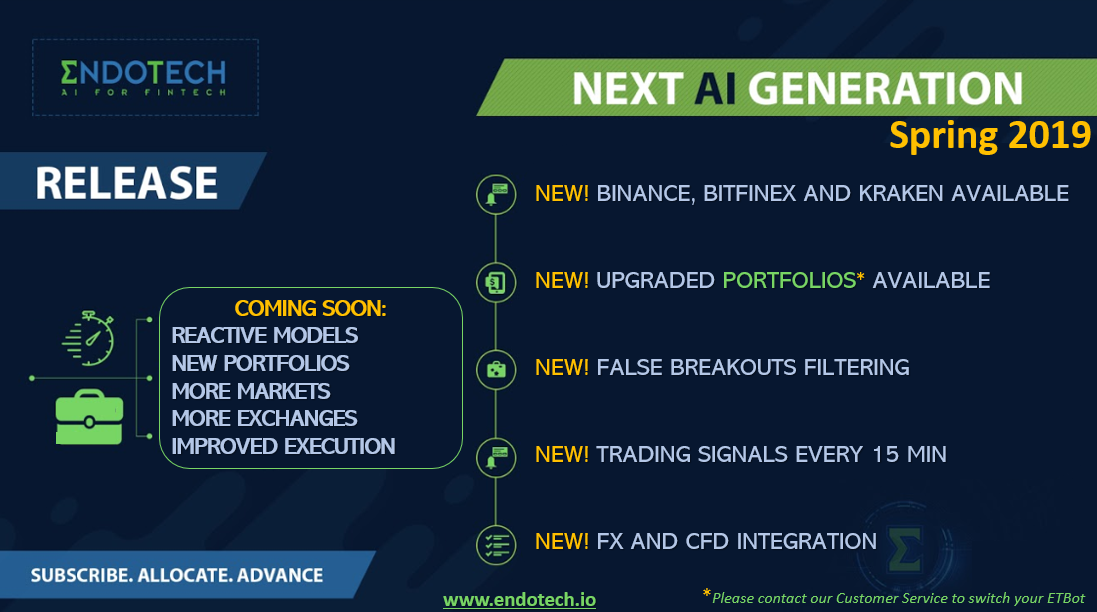

Dear current and future customers, the first release of 2019 is finally live! Read on to learn more about the newest versions and features.

We are introducing:

V1.4 for Gold-VIP clients

V1.5 for institutional clients

Several updates require your attention:

1- Reactive Models

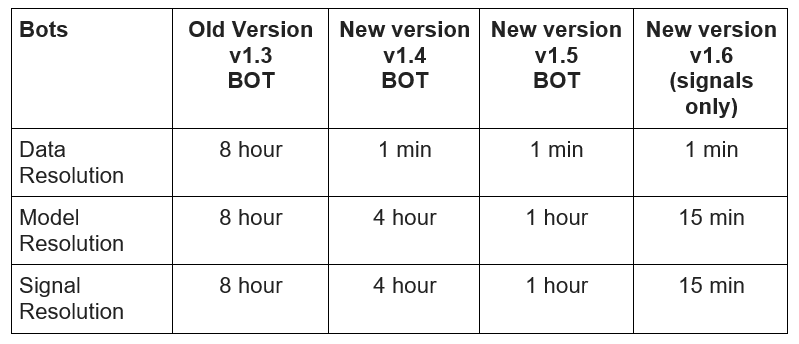

The resolution of data, models, and signals, is one of the key elements which strategy developers must determine.

Concerning data resolution, generally speaking, the more data, the better, at least theoretically. In practice, many providers offer low-resolution data of 1 to 24 hours, clean, and free of charge. While dropping down to 1 minute or lower (every transaction), and ideally to a delta of Level 2 (order book depth) data, it is pricey, hard to store, and often not so clean. Add to this the complexity of multiple exchanges and multiple asset types (cryptocurrencies, forex, ETFs, and stocks), and you can readily see my point of theory versus practice.

We started with 1-day data, transitioned to 8 hours, and now are down to 1 minute. In the next version, we will add level 1 data (ask/bid/price), and by the end of the year, we’ll reach ultimate Level 2 (order book) data resolution.

About model resolution – again, the more details that can be imported into the model, the better it works, in theory. In practice, reducing dimensions by deciding from the outset how to normalize your data takes care of many issues such as overfitting, abnormalities, and more. So, while we were initially fine with the data we had across cryptocurrencies, market changes demanded a more sophisticated model.

Finally, on to signals resolution. When considering signals resolution in an ideal world, we think of signals generation immediately when model conditions for entry and exits are met. The higher the frequency – the better.

This is the wrong approach in thin markets like crypto. From the beginning of the bot’s operation, I was concerned about the overall status of the exchanges (hidden/market-making bots), the quality of APIs and order execution, and the quality of OMS providers. And I was right to worry.

Order execution costs = commissions + spreads + slippage. This has been our main concern for the last few months. First, we resolved commissions by moving from taker to maker fees. Then we introduced smart limit orders to improve slippage. Despite this, slippage still happened, and the process of ensuring that all orders were executed properly was a long struggle. A thin market is a thin market. Therefore, before we decided to increase signal resolution, we had to take care of our order execution infrastructure.

Example of v1.5 vs v1.3 entering with a buy order at 107.00 versus 114.00.

However, one crucial point to qualify is that the higher the resolution, the higher the number of fake signals. At this point, EndoTech’s AI/ML decided to introduce optimized filters to reduce fake signal frequency.

2- Connectivity

In v1.4 and v1.5 we introduce direct connectivity to Binance, Bitfinex, and Kraken. We are connected to numerous crypto exchanges through third-party providers, so clients can submit requests to support@endotech.io to check whether connectivity is available for specific exchanges. We then follow up by developing direct connectivity once we see enough interest.

3- Forex & CFD Integration

We came from fiat currencies, and we are returning to fiat currencies. Given the recent down-cycle in crypto-volatility and liquidity, we decided to add more markets. We view EndoTech as a provider of risk-reduction, systematic trading technology in high-volatility (return) markets. From v1.4, we will be adding markets that display high volatility and leveraged markets.

We are now in the process of connecting to two major forex brokers’ API’s. Meanwhile, signals of ETBot Forex that feature a mix of 5 & 15 min reversal and breakout systems will be available on our website shortly (in the next mini-update).